Happy Sunday,

Fed holds rates steady. Consumers think credit approval chances have dimmed. Biz2Credit, Womply reach FTC settlements. Figure Markets launches, raises $60Mn. Credova acquired. Galileo expands BNPL capabilities. Onyx Private pivots to B2B. TransUnion consumer credit data.

In case you missed it – check out our recently released Q4 Consumer Lending Review, covering consumer macro trends, fintech/consumer lender earnings, and MPL new issue volume.

New here? Subscribe here to get our newsletter each Sunday. For even more updates, follow us on LinkedIn (PeerIQ by Cross River).

Fed Holds Rates Steady

The Fed unanimously voted to leave rates unchanged at 5.25-5.5% at last week’s FOMC meeting. Officials maintained their current outlook, expecting three rate cuts later this year and slowing the pace of reducing bond holdings. Fed Chair Powell declined to provide more specificity on when the central bank might start cutting, beyond saying “at some point this year.” Officials are still looking for additional data points that inflation is heading towards its long-term 2% target.

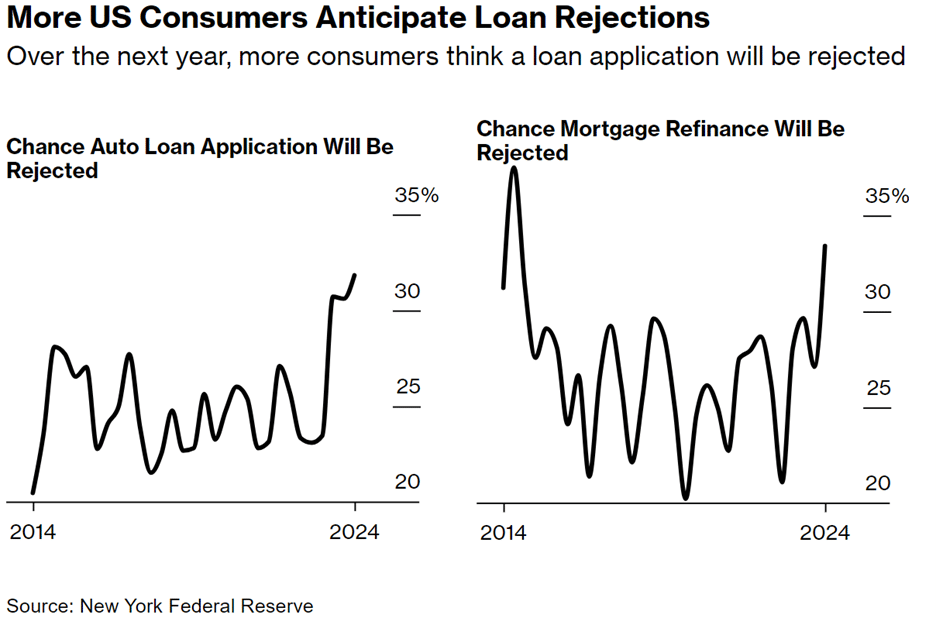

Meanwhile, a recent NY Fed survey shows more Americans expect they’d be declined for a car loan or mortgage refinance if they applied. One-third of respondents said they didn’t think they would be approved for a refinance in the next year, while nearly 32% said they expected to be declined for an auto loan.

Image: Bloomberg

Biz2Credit, Womply Reach FTC Settlements on PPP

The FTC has reached settlements with two fintech providers of PPP loans, Biz2Credit and Womply. Combined, the two will pay a combined $59Mn to settle allegations they deceived small business applicants seeking COVID-era Paycheck Protection Program loans. Biz2Credit and a subsidiary will pay $33Mn. The FTC alleges Biz2Credit misled consumers by saying applications would be processed in an average of 10-14 days, when, in reality, applications typically took more than a month. Biz2Credit argues that the processing time should have taken into account all applicants, including those the company promptly rejected as potentially fraudulent or ineligible. The company also emphasized it reached SMBs bank lenders didn’t, with 47% of the businesses it funded being minority-owned and 32% being women-owned.

Womply, meanwhile, agreed to pay $26Mn to settle allegations that it advertised one-person businesses, including entities like gig workers, could qualify for PPP loans. According to the FTC complaint, more than 60% of Womply applicants never qualified for funding. The company also failed to provide customer service, the FTC said, deactivating its phone line after receiving nearly 5,000 requests for support in a month. Applicants seeking online chat support often didn’t receive replies for hours or days. In December 2022, the SBA banned Womply from working with the agency “in any capacity,” following a Congressional report that highlighted it as having some of the laxest anti-fraud standards in the PPP program.

Figure Markets Raises $60Mn

Mike Cagney’s Figure announced the launch of Figure Markets, a crypto and securities exchange. Concurrently, Figure Markets announced its $60Mn Series A, led by Pantera Capital, Jump Crypto, and Lightspeed Faction. Figure Markets intends for the exchange to use so-called “decentralized custody” by leveraging multi-party computation wallets, which require multiple parties to authorize asset movements. Figure Markets aims to improve “collateral mobility” by supporting the collateralization of one type of asset with a different asset type, as well as crypto lending, margining, and netting. The company’s U.S.-based exchange will launch next month, with plans to add an offshore exchange sometime in the second quarter.

BNPL Firm Credova Acquired

PublicSq, a sort of eBay or Amazon aligned with rightwing values, has acquired buy now, pay later firm Credova, which specializes in providing financing for firearms. Credova is the only BNPL firm in the U.S. that supports firearm transactions. Part of the justification for the transaction is PublicSq’s desire to hedge against payment processors who may be unwilling to work with merchants in certain categories, including guns. Last year, Credova did about $15Mn in revenue and was profitable, according to Axios.

Galileo Expands BNPL Offerings

Galileo, a business unit of SoFi, announced an expansion of the buy now, pay later capabilities it supports. It will now support debit and credit issuers offering post-purchase installment payment plans via cardholders’ existing accounts. The option may be particularly attractive to neobank-like fintechs, which often lack credit features. Enabling post-pay plans can give their customers greater flexibility while allowing fintechs to earn an incremental revenue stream in the form of installment fees. Further, because the plans are opted into after the fact, cardholders are able to use them at any merchant.

Onyx Makes B2B Pivot

Onyx Private, a YC-backed startup that sought to provide private banking-like services to upwardly mobile Millennials and Gen Z is following in the path of other failed neobanks: the B2B pivot. Earlier this month, the company informed users it was terminating banking operations and that their accounts would be closed. But rather than shut down altogether, the company will shift to a “B2B white-label platform-as-a-service model for community banks, regional banks, and credit unions,” Onyx co-founder and CEO Victor Santos told Techcrunch. The company had raised $4.1Mn in equity and partnered with i3 Bank to provide deposit accounts and debit cards.

TransUnion Releases February Consumer Credit Data

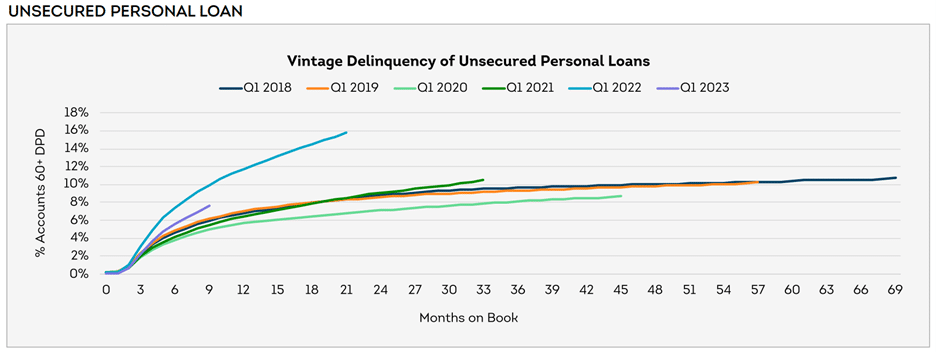

TransUnion just released its monthly credit snapshot for February, showing that 60+ DPDs increased (MoM) across the board, with Mortgage +9bps, Unsecured Personal Loans (“UPLs”) +5bps, Auto +1bp, and Bankcard +1bp. This marks the seventh consecutive month of DPD increases for Mortgage, Auto, and Bankcard. UPL 60+ DPDs have risen in six of seven of the last months.

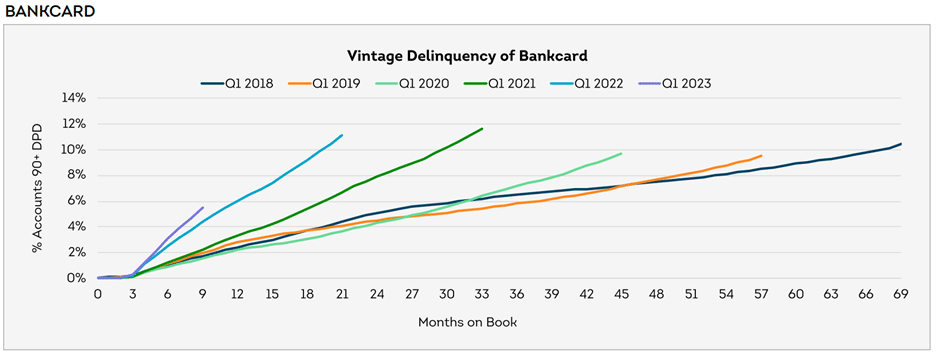

Looking at bankcard, 90+ DPDs rose 3bps MoM, marking an eighth straight month of increases, but 30+ DPDs fell (6)bps breaking an 8-month streak of increases. Q1 2023 vintage DPDs continue to track higher than Q1 2022 and well above Q1 2018-2021 vintages. At the same time, average bankcard balances fell (0.9)% MoM, to $6,241.

Source: TransUnion

Turning to originations, we got information on UPL origination volume for the November 2023 – December 2023 period (lag due to reporting time). December fintech UPL originations fell across all risk tiers with super prime (9.0)%, prime plus (15.1)%, prime (18.7)%, near prime (12.7)%, and subprime (7.6)% on a MoM basis. Super prime originations were unchanged from the year prior while all other risk tiers remained below Dec 2022 levels, with prime plus (23.2)%, prime (45.2)%, near prime (47.7)%, and subprime (43.7)%

Credit unions reversed their November MoM UPL origination gains, reporting December declines for super prime (10.5)%, prime plus (9.9)%, prime (6.2)%, near prime (7.6)%, and subprime (17.9)%. On a YoY basis, super prime +7.0% and prime plus +0.7% originations were above 2022 levels, while prime (5.6)%, near prime (7.7)% and subprime (4.3)% lagged

Finance companies reported MoM UPL origination declines for super prime (6.4)% and prime plus (17.1)% while reporting origination growth for prime +6.5%, near prime +8.1%, and subprime +20%. On a YoY basis, super prime (28.9)% and prime plus (24.9)% remained below December 2022 levels, while prime +4.8%, near prime +1.1% and subprime +2.1% were above.

Banks reported December declines across super prime (20.3)%, prime plus (17.2)%, prime (11.1)% and near prime (3.2)%. Subprime grew originations +2.8%. Bank originations were higher than December 2022 levels for super prime +5.4%, near prime +7.2%, and subprime +25.0%, while prime plus (16.9)% and prime (16.8)% lagged 2022 levels.

In February, fintech companies overtook finance companies for the lead in UPL balances, with 28.0% of the total, compared to 27.7% for finance companies. Banks accounted for 24.0% and credit unions for 20.3%. Average UPL balances per consumer rose +0.7% on a MoM basis, to $11,968 in February.

Overall, consumers are missing payments at a greater rate. While 60+ DPDs increased across the board, 30+ DPDs declined for Auto (10)bps and Bankcard (6)bps on a MoM basis and average bankcard balances declined for the second straight month.

UPL’s Q1 2023 vintage continues to perform better than Q1 2022, likely due to mid-2022 credit tightening. Q1 2023’s bankcard vintage is performing worse than 2022, while auto’s is at comparable levels. Both bankcard and auto vintages for 2022/23 are performing worse than historic cohorts (2018-2021).

Source: TransUnion

Wrapping things up with fintech. Fintech UPL originations remain well below 2022 levels, especially for the prime and below contingent (down (40)%+ YoY for prime and below risk tiers). Fintechs pursued more aggressive growth from 2021-1H22, expanding credit access to consumers. At this point, they have yet to return to those levels of origination. Despite the drop in originations, fintechs regained the lead in UPL balances in February from finance companies. This is likely driven by the much larger average new loan amount from fintechs ($15,672 as of December) compared to finance companies ($3,419 as of December).

In the News:

Credit unions’ top regulator sounds the alarm. Is Congress listening? (American Banker, 3/14/2024) Credit unions’ interests are not always aligned with their members, NCUA regulators warn.

CFPB director Rohit Chopra stresses open banking finally coming to US (Retail Banker International, 3/18/2024) Chopra argues open banking will enable smaller banks to compete with larger rivals.

Solaris raises €96 million in funding (Finextra, 3/19/2024) German BaaS bank Solaris announced €96Mn in funding.

Goldman closes GreenSky sale, and Synovus sees an edge (American Banker, 3/15/2024) Goldman sold the home improvement lender just two years after buying it.

The Apple Pay Threat Facing Banks (PYMNTS, 3/18/2024) By offering its own credit card and savings account (through Goldman Sachs), Apple’s wallet competes more directly with banks.

Klarna Takes Aim at Visa, Mastercard With Open Banking Push (3/14/2024) Klarna’s emphasis on account-to-account payments in the U.K. is a shot across the bow for Visa, Mastercard.

CBW Bank, A BaaS Pioneer, Is Up For Sale (Fintech Business Weekly, 3/17/2024) The tiny Kansas bank was an early pioneer in fintech, banking-as-a-a-service.

Elavon & BMO to bring payment solutions platform for US clients (IBS Intelligence, 3/19/2024) U.S.-based payment processor Elavon is partnering with BMO to bring payment solutions to the bank’s clients.

Bolt to become Checkout.com’s exclusive one-click checkout provider (Finextra, 3/18/2024) Payment processor Checkout.com has partnered with one-click checkout firm Bolt.

What does the future hold for social media-powered payments? (American Banker, 3/18/2024) Do users really want banking and payments fused with their social media platforms?

Banks are in limbo without a crucial lifeline. Here’s where cracks may appear next (CNBC, 3/19/2024) Per Klaros Group, 282 banks have high levels of CRE exposure and large unrealized losses from rising rates.

BlackRock Creates Fund With Securitize, a Big Player in Real-World Asset Tokenization (Coindesk, 3/19/2024) Investment giant BlackRock is taking steps towards tokenization.

Ramp CEO says the fintech startup is just scratching the surface (Techcrunch, 3/19/2024) CEO Glyman argues startups like Ramp are still in their early days.

Lighter Fare:

Explosive ‘devil comet’ returns for 1st time in 71 years during April 8 eclipse, NASA says (ABC News, 3/18/2024) A rare comet is set to pass by the earth and may be visible during April 8’s solar eclipse.